NVIDIA’s Blackwell is the company’s latest GPU architecture, succeeding 2022’s Hopper (H100) and 2020’s Ampere (A100) architectures nvidianews.nvidia.com cudocompute.com. It is named after mathematician David Blackwell, reflecting NVIDIA’s tradition of honoring computing pioneers cudocompute.com. Blackwell GPUs represent a major leap in performance and capabilities designed to meet the exploding demands of artificial intelligence (AI) at scale. NVIDIA CEO Jensen Huang has hailed Blackwell as “the engine to power [the] new industrial revolution” of AI nvidianews.nvidia.com. In this report, we provide a comprehensive overview of Blackwell’s technology, the innovations it brings over previous generations, and its significance for large-scale AI training and inference. We also explore use cases across industries – from massive language models to robotics and healthcare – and compare Blackwell to competing AI accelerators from AMD, Intel, Google, and leading startups. Finally, we discuss future trends in AI hardware acceleration and the market impact of this new generation of AI chips.

Technical Overview of the Blackwell Architecture

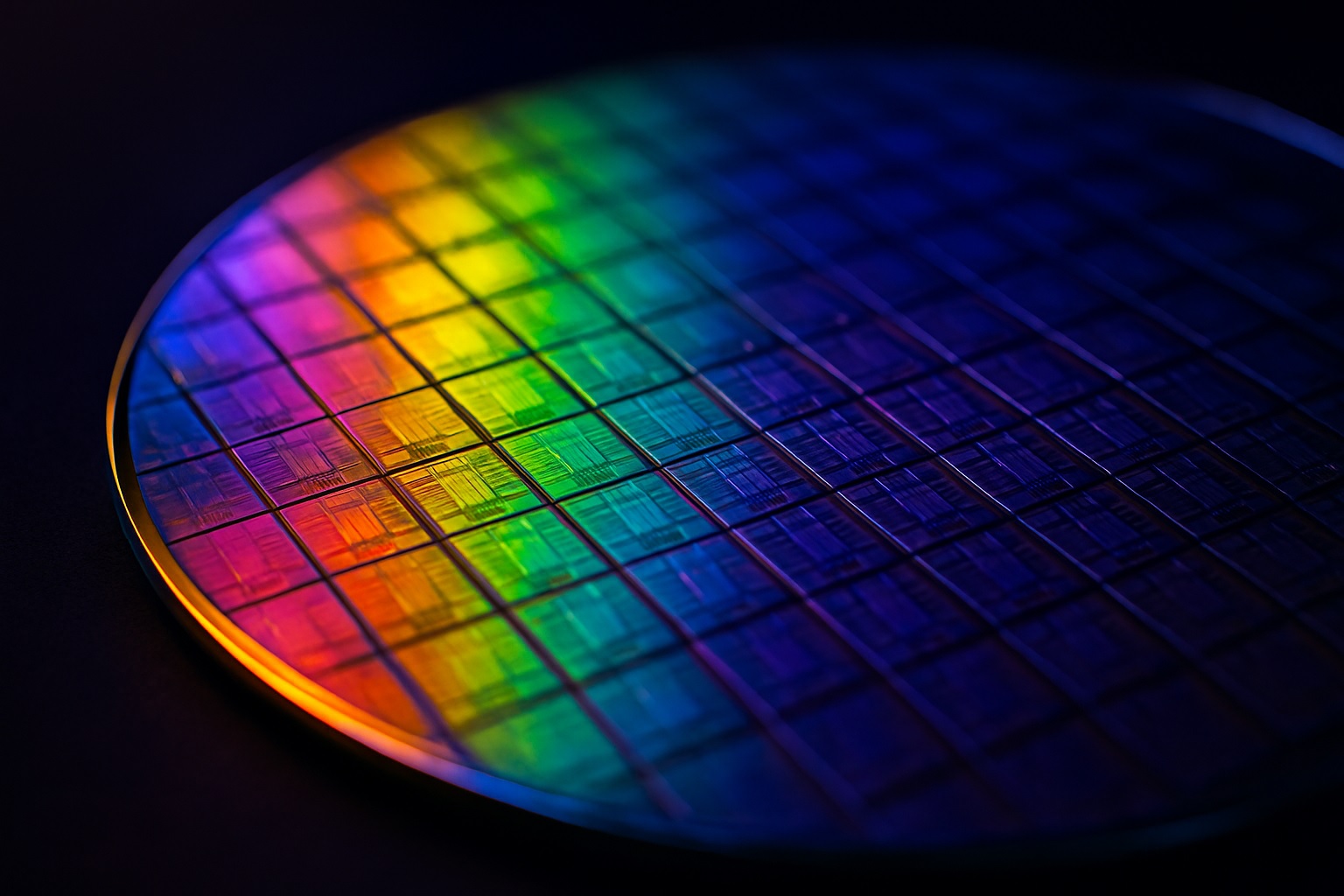

Blackwell GPUs are built on TSMC’s 4N+ process, packing an astonishing 208 billion transistors on a single package nvidia.com. This is nearly 2.5× the transistor count of NVIDIA’s prior Hopper H100 (~80 billion) and makes Blackwell the world’s most complex chip to date cudocompute.com nvidianews.nvidia.com. To achieve this, NVIDIA employed a multi-die architecture: two reticle-limit GPU dies are placed on one module and linked by a high-speed chip-to-chip interconnect running at 10 terabytes per second nvidia.com cudocompute.com. In effect, the two dies act as a unified GPU, allowing Blackwell to vastly scale up core counts and on-package memory while still fitting within manufacturing constraints. Each Blackwell GPU die is paired with four stacks of next-generation HBM3e high-bandwidth memory (8 stacks total per GPU module), yielding up to 192 GB of HBM memory on high-end models cudocompute.com. The total memory bandwidth reaches an enormous ~8 TB/s per GPU (two dies combined), a 5× increase over Hopper’s memory bandwidth cudocompute.com. This massive memory capacity and throughput let Blackwell handle AI models up to ~740 billion parameters in memory – roughly 6× larger than what Hopper could support cudocompute.com.

Beyond sheer size, Blackwell introduces six transformative technologies in its architecture nvidianews.nvidia.com nvidianews.nvidia.com:

- Next-Gen GPU Superchip: As noted, Blackwell is the first NVIDIA GPU built as a dual-die “superchip.” This design delivers unprecedented parallelism and compute density in one accelerator. A single Blackwell GPU provides 5× the AI performance of H100 (five times Hopper) thanks to its greater scale and new cores cudocompute.com cudocompute.com. It supports on-package memory far exceeding prior generations (nearly 200 GB per GPU), critical for today’s enormous models.

- Second-Generation Transformer Engine: Blackwell features an improved Transformer Engine (TE) to accelerate AI calculations, especially for Transformer-based models like large language models (LLMs). The new TE introduces support for 4-bit floating point (FP4) data and fine-grained “micro-tensor scaling” techniques to preserve accuracy at these ultra-low precisions nvidia.com nvidianews.nvidia.com. In practice, this means Blackwell can double the effective throughput and model size for AI inference by using 4-bit weights/activations when appropriate (with minimal accuracy loss). The Blackwell Tensor Cores provide about 1.5× more AI FLOPS than before and include specialized hardware to 2× accelerate Transformer attention layers, which are a bottleneck in LLMs nvidia.com. Combined with NVIDIA’s software (TensorRT-LLM compiler and NeMo libraries), this yields up to 25× lower latency and energy for LLM inference compared to Hopper nvidianews.nvidia.com nvidianews.nvidia.com. In fact, Blackwell can serve trillion-parameter models in real time – a capability simply out of reach for previous GPUs nvidianews.nvidia.com.

- Fifth-Generation NVLink Interconnect: To enable scaling beyond one monster GPU, Blackwell debuts NVLink 5, NVIDIA’s latest high-speed interconnect for multi-GPU connectivity. NVLink 5 delivers 1.8 TB/s of bidirectional bandwidth per GPU, a huge jump that allows linking up to 576 GPUs in a single cluster with fast, all-to-all communication nvidia.com nvidianews.nvidia.com. For perspective, Hopper’s NVLink allowed ~18 GPUs per server; Blackwell’s new NVLink Switch chips enable creating an NVL72 domain of 72 GPUs that behave like one giant accelerator nvidia.com nvidia.com. The NVLink Switch provides an aggregate 130 TB/s bandwidth in a 72-GPU subsystem nvidia.com. This is crucial for training multi-trillion-parameter AI models that need dozens or hundreds of GPUs working in unison without communication bottlenecks. The new NVLink also supports NVIDIA’s SHARP protocol to offload and accelerate collective operations (like all-reduce) in hardware with FP8 precision, further boosting multi-GPU efficiency nvidia.com cudocompute.com.

- Reliability, Availability, Serviceability (RAS) Engine: Given that Blackwell-based systems may run massive AI workloads for weeks or months continuously, NVIDIA has built in hardware for reliability. Each GPU includes a dedicated RAS engine that monitors thousands of data points for early signs of faults or performance degradation nvidia.com nvidia.com. This engine uses AI-driven predictive analytics to forecast potential issues and can proactively flag components for service, thus minimizing unexpected downtime. It provides detailed diagnostic info and helps coordinate maintenance – essential features as AI infrastructure scales to “AI factories” with tens of thousands of GPUs in data centers nvidia.com nvidia.com.

- Secure AI Processing: Blackwell is the first GPU with Confidential Computing capabilities built-in. It implements a trusted execution environment with memory encryption and isolation (TEE-I/O), so that sensitive data and models can be processed in GPU memory without risk of exposure nvidia.com. What’s notable is that Blackwell’s encryption has negligible performance overhead, delivering nearly the same throughput as normal mode nvidia.com. This appeals to privacy-sensitive industries like healthcare and finance, which can now run AI workloads on shared infrastructure while ensuring data confidentiality nvidianews.nvidia.com. From secure medical imaging analysis to multi-party training on private datasets, Blackwell enables new use cases by removing security barriers.

- Decompression & Data Acceleration: To feed its hungry compute engines, Blackwell adds a Decompression Engine that offloads data decompression tasks onto the GPU hardware nvidia.com nvidia.com. Modern analytics pipelines often compress datasets (e.g. using LZ4, Snappy) to improve storage and I/O – Blackwell can transparently decompress this data at line-rate, avoiding CPU bottlenecks. Additionally, when paired with NVIDIA’s Grace CPU, Blackwell can directly access system memory at 900 GB/s via NVLink-C2C, enabling fast streaming of huge datasets nvidia.com nvidia.com. Together these features accelerate data-heavy workloads like ETL, SQL analytics, and recommender systems. NVIDIA expects that in coming years, more of the $10s of billions spent on data processing will shift to GPU-accelerated approaches nvidianews.nvidia.com.

Performance Benchmarks: Thanks to the above innovations, Blackwell delivers a generational performance leap. At equivalent precision, a single high-end Blackwell GPU (B100 model) offers roughly 5× the AI training throughput of H100 (Hopper) and about 25× the throughput of an older Ampere A100 cudocompute.com nvidianews.nvidia.com. For example, Blackwell can achieve up to 20 PetaFLOPS of AI compute at FP8/FP6 precision, versus ~8 PFLOPS for H100 cudocompute.com. Even more impressively, with FP4 it reaches 40 PFLOPS, five times Hopper’s FP8 capability cudocompute.com. In practical terms, this means tasks like GPT-3 (175B parameter) inference that took seconds on H100 can run in a fraction of a second on Blackwell. NVIDIA disclosed that Blackwell enables real-time inference on models up to 10× larger than was previously possible nvidianews.nvidia.com. Early industry benchmarks bear this out – in the MLPerf inference tests, systems with the new Blackwell GPUs outperformed all competitors, whereas even AMD’s latest MI300-series accelerators only matched the performance of Nvidia’s last-gen H100/H200 on smaller LLMs spectrum.ieee.org. In one Llama-70B benchmark, Blackwell-based submissions achieved 30× higher throughput than an equal number of H100 GPUs, while also cutting energy use dramatically nvidianews.nvidia.com.

It’s worth noting that achieving these gains in practice depends on software optimization. NVIDIA’s full-stack approach – from CUDA libraries to the new TensorRT-LLM compiler – helps applications easily tap into Blackwell’s features. For instance, automatic precision scaling in the Transformer Engine allows users to benefit from FP4 speedups with minimal code changes nvidia.com. This tight integration of hardware and software is a key advantage for NVIDIA. By contrast, competitors often struggle with software maturity; industry analysts point out that while AMD’s MI300 hardware is “catching up” to Nvidia, its software ecosystem still lags behind CUDA in ease-of-use and optimization research.aimultiple.com research.aimultiple.com.

Innovations Compared to Hopper and Ampere

Blackwell introduces several major architectural advances over NVIDIA’s previous GPU generations:

- Multi-Chip Module (MCM) Design: Hopper (H100) and Ampere (A100) were monolithic GPUs on a single die. Blackwell is NVIDIA’s first foray into an MCM GPU – effectively two GPUs in one. This yields massively higher transistor budgets (208B vs 80B) and memory capacity (up to 192 GB vs 80 GB) cudocompute.com cudocompute.com. Competitors like AMD pioneered MCM GPUs in the MI200/MI300 series, but NVIDIA’s implementation unifies the dual die into one GPU address space cudocompute.com, making it easier for programmers to use. The MCM approach also improves manufacturing yield (smaller dies are easier to produce) and scalability for future designs.

- Enhanced Tensor Cores & FP4 Precision: While Ampere introduced Tensor Cores and Hopper added FP8 support via the first-gen Transformer Engine, Blackwell ups the ante with native 4-bit precision support nvidia.com. It adds “Ultra” Tensor Cores that handle FP4 matrix ops and the new microscaling algorithms to maintain accuracy at 4-bit nvidia.com. This is significant because many AI inference workloads can tolerate lower precision, so FP4 can effectively double throughput vs FP8. Blackwell’s Tensor Cores are also better tuned for sparsity and attention patterns common in Transformers, whereas Ampere/Hopper had more general-purpose designs. The result is a big jump in performance on Transformer models specifically (2× faster attention in Blackwell) nvidia.com.

- Memory and Interconnect: Blackwell uses HBM3e memory with higher capacity and bandwidth. Hopper’s H100 had 80 GB HBM (3 TB/s); Blackwell B100 provides up to ~192 GB HBM at ~8 TB/s cudocompute.com. Additionally, Blackwell’s NVLink 5 vastly improves multi-GPU scaling, as described earlier. Hopper could only directly connect 8 GPUs in a node (with ~0.6 TB/s links per GPU); Blackwell can connect 72 or more at far higher bandwidth nvidia.com nvidianews.nvidia.com. This addresses the scaling demands of today’s distributed training on dozens of GPUs, reducing communication overheads.

- Confidential Computing and RAS: Prior architectures had only limited security (e.g., Hopper introduced encrypted VM isolation for multi-instance GPU partitions). Blackwell is the first with full GPU-level confidential compute, encrypting data in use nvidia.com. It’s also the first NVIDIA GPU with a dedicated RAS core for predictive maintenance nvidia.com. These features indicate a maturing of GPU technology for mission-critical enterprise and cloud deployments, where uptime and data privacy are as important as raw speed. Ampere and Hopper lacked such robust built-in telemetry and encryption for AI workloads.

- New Data Processing Engines: Blackwell’s decompression hardware is a new addition – previous GPUs left data loading to CPUs or DPUs. By accelerating tasks like JSON parsing or compressed data decoding on-GPU, Blackwell can speed up data pipelines end-to-end, not just neural network math nvidia.com. This reflects a broadening of the GPU’s role: from pure ML math accelerator to a general data processing workhorse for analytics and ETL. It’s a nod to industry trends where AI and big data analytics are converging.

In summary, Blackwell’s improvements over Hopper/Ampere can be seen in five key dimensions: (1) Compute (more TFLOPS via larger scale and FP4), (2) Memory (more capacity/bandwidth), (3) Connectivity (NVLink clusters), (4) Resilience/Security (RAS engine, encryption), and (5) Data handling (compression engines). These enhancements make Blackwell far better equipped to tackle large-scale AI than its predecessors.

Addressing the Demands of Large-Scale AI Training & Inference

Today’s frontier AI models – whether it’s multi-billion-parameter language models, complex vision transformers, or recommender systems processing petabytes of data – demand enormous compute and memory. Blackwell was designed explicitly to meet these challenges:

- Unprecedented Model Scale: As noted, a single Blackwell GPU can accommodate models on the order of 0.5–0.7 trillion parameters in memory cudocompute.com. And if that isn’t enough, Blackwell-based systems scale out to hundreds of GPUs with fast interconnects, allowing training of models with tens of trillions of parameters by spreading parameters across GPUs nvidianews.nvidia.com nvidia.com. For example, NVIDIA’s DGX SuperPOD using Blackwell can connect 576 GPUs, offering ~1.4 ExaFLOPs of AI performance and 30 TB of unified HBM memory nvidianews.nvidia.com nvidianews.nvidia.com. That capability is what enables exploring GPT-4 and beyond, where model size might be in the multi-trillion range. In short, Blackwell addresses the scale problem with raw brute force – bigger chips and more of them seamlessly linked.

- Higher Throughput, Lower Latency: For AI inference, especially interactive applications (chatbots, real-time vision, etc.), latency and cost are critical. Blackwell’s transformer optimizations and FP4 precision directly target inference efficiency, delivering up to 25× lower latency and energy per query for LLMs versus the prior gen nvidianews.nvidia.com. In practice, this could mean that a query to a 1-trillion-parameter model that needed a large GPU cluster could now be served by a smaller Blackwell cluster, faster and more cheaply. Companies like OpenAI and Meta anticipate using Blackwell to serve LLMs to users at scale, where every reduction in cost per inference is significant nvidianews.nvidia.com nvidianews.nvidia.com.

- Training Efficiency & Cost: Training a state-of-the-art model can cost tens of millions of dollars in compute. Blackwell aims to reduce this via faster training times and better node utilization. Its combination of more FLOPS and better networking means that a given cluster of Blackwell GPUs can train a model in a fraction of the time (or, conversely, achieve higher accuracy in the same time). NVIDIA claims that large LLM training on Blackwell can be done at up to 25× less energy than on Hopper nvidianews.nvidia.com. This is not just due to chip improvements, but also software advances (e.g. Blackwell-compatible compilers and mixed-precision schemes). Faster training cycles enable researchers to iterate on model designs more quickly – a big boost for AI development velocity.

- Memory Capacity for Large Batches and Datasets: Blackwell’s expanded memory is a boon for both training and inference. For training, it can support larger batch sizes or sequences, improving training efficiency and model quality. For inference, it can cache entire models or long contexts (important for LLMs that need long prompts) on one GPU, avoiding slow CPU memory swaps. Moreover, with the Grace CPU link (900 GB/s), a Blackwell GPU can offload additional data to CPU memory without much penalty nvidia.com. This effectively creates a memory hierarchy where GPU+CPU share coherent memory – useful for giant recommendation datasets or graph analytics where working data may exceed GPU memory.

- Always-On Reliability: In enterprise and cloud settings, AI workloads often run as services continuously. Blackwell’s reliability features (the RAS engine) mean it can run these prolonged workloads with minimal interruptions, automatically detecting issues like memory errors, link failures, or thermal anomalies and alerting operators nvidia.com nvidia.com. This addresses a practical demand: as companies deploy AI into production (e.g., feeding live recommendations or running autonomous factory robots), they need the hardware to be as dependable as traditional IT infrastructure. Blackwell moves in that direction by incorporating the kind of reliability engineering previously seen in mission-critical CPUs and servers.

In summary, Blackwell squarely targets the needs of “AI factories” – large-scale AI infrastructure powering everything from research labs to cloud AI services nvidianews.nvidia.com. It provides the scale, speed, efficiency, and robustness needed as AI models and datasets continue their exponential growth.

Use Cases and Applications Across Industries

NVIDIA’s Blackwell is not only about pushing benchmarks – it is built to unlock new applications of AI across a variety of fields. Here we examine how Blackwell GPUs are poised to impact several key domains:

Generative AI and Large Language Models (LLMs)

The rise of generative AI (GPT-3, GPT-4, etc.) is a primary driver for Blackwell’s development. Blackwell GPUs excel at both training and deploying large language models:

- Training Giant Models: Research labs and companies like OpenAI, Google DeepMind, and Meta are training ever-larger LLMs. Blackwell enables training runs that were previously impractical. With its multi-GPU scalability and faster throughput, it’s feasible to train models with trillions of parameters or train 100+ billion-parameter models in significantly less time. In fact, Meta’s CEO noted they “look forward to using NVIDIA’s Blackwell to help train [their] open-source Llama models and build the next generation of Meta AI” nvidianews.nvidia.com. The faster iteration cycle means more experimentation and potentially breakthroughs in model capabilities. Additionally, Blackwell’s Transformer Engine is fine-tuned for transformer-style networks, which can lead to better hardware utilization and lower cost to reach a target accuracy.

- Scaling LLM Inference Services: Deploying an LLM-powered service (like a chatbot that serves millions of users) is extremely computationally expensive. Blackwell substantially reduces the hardware needed to serve a given load. Jensen Huang stated that Blackwell “enables organizations to run real-time generative AI on trillion-parameter models at up to 25× less cost” than before nvidianews.nvidia.com. For a cloud provider, that means they can economically offer GPT-like services to customers. It also opens the door to real-time applications – e.g. assistants that can sift through enormous documents or answer very complex queries on the fly, thanks to Blackwell’s low latency. Google’s CEO Sundar Pichai highlighted how Google plans to use Blackwell GPUs across Google Cloud and Google DeepMind to “accelerate future discoveries” and serve its own AI products more efficiently nvidianews.nvidia.com.

- Mixture-of-Experts (MoE) Models: Blackwell’s architecture (huge memory + fast interconnect) is also beneficial for MoE models, which dynamically route inputs to different expert sub-models. These models can scale to trillions of parameters but require fast communication between experts (often spread across GPUs). The NVLink Switch and large GPU memory help keep MoEs efficient, possibly enabling a new wave of sparse expert models that were bandwidth-limited on prior hardware nvidia.com cudocompute.com.

Robotics and Autonomous Vehicles

AI hardware is increasingly central to robotics – both for training robots in simulation and for powering AI brains inside robots/vehicles:

- Robotics Research and Simulation: Training robotic control policies (e.g. for drones, industrial robots) often uses massive simulation environments and reinforcement learning, which are GPU-intensive. Blackwell can accelerate physics simulation (Omniverse, Isaac Sim, etc.) and the training of control networks. NVIDIA reported that Grace+Blackwell systems achieved up to 22× faster simulation speeds for dynamics compared to CPU-based setups cudocompute.com. This means faster development of robot motion planning, better digital twins for factories, and more affordable training for complex robotics tasks. Researchers can run richer simulations (with higher fidelity or more agents) on a single Blackwell node than before, leading to better-trained robots.

- Autonomous Vehicles (AV) – Drive Thor Platform: NVIDIA’s automotive AI computer, DRIVE Thor, will be built on the Blackwell GPU architecture nvidianews.nvidia.com. This platform is intended for next-generation self-driving cars, robotaxis, and trucks. Blackwell’s strengths in transformers and AI inference align with new trends in AV software – for instance, using transformer-based perception models or large language models for in-cabin assistants. DRIVE Thor with Blackwell can deliver up to 20× the performance of the current Orin platform (which was Ampere-based) while consolidating vision, radar, lidar processing and even in-car entertainment AI onto one computer medium.com. Leading automakers and AV companies (BYD, XPENG, Volvo, Nuro, Waabi, and others) have already announced plans to adopt DRIVE Thor for vehicles launching in 2025+ nvidianews.nvidia.com nvidianews.nvidia.com. This will enable Level-4 autonomy features, more advanced driver assistance, and even generative AI in the car (for voice assistants or passenger entertainment). In essence, Blackwell in the car provides the AI horsepower to analyze countless sensor inputs in real time and make driving decisions with the needed safety margin.

- Industrial and Healthcare Robots: Blackwell is also finding use in specialized robots in healthcare and industry. For example, at GTC 2025 in Taiwan, developers showcased AI-powered medical robots that leverage Blackwell GPUs for their AI processing worldbusinessoutlook.com. These include autonomous mobile robots for hospitals and humanoid assistants that can interact with patients. Each robot used a Blackwell GPU in combination with a large language model (in this case “Llama 4”) and NVIDIA’s Riva speech AI to engage naturally with people worldbusinessoutlook.com. The Blackwell GPU provides the on-board muscle to understand speech, run the LLM for reasoning, and control the robot’s actions in real time. Hospital trials reported improved patient service and reduced staff workload thanks to these AI robots worldbusinessoutlook.com worldbusinessoutlook.com. In manufacturing, one can imagine Blackwell-powered robotic systems performing complex visual inspection or coordinating fleets of warehouse robots with AI planning algorithms. The extra performance allows deploying more sophisticated AI models on robots, making them smarter and more autonomous.

Data Center AI Services and Cloud Providers

Given its scale, Blackwell is naturally at home in the data center, where it will power both public cloud services and private enterprise AI infrastructure:

- Cloud AI Instances: All major cloud providers – Amazon AWS, Google Cloud, Microsoft Azure, and Oracle – have announced plans to offer Blackwell-based GPU instances nvidianews.nvidia.com. This means startups and enterprises can rent Blackwell accelerators on demand for training models or running AI applications. Cloud providers are even partnering directly with NVIDIA on custom systems; AWS revealed a co-engineering project “Project Ceiba” to integrate Grace-Blackwell superchips with AWS’s networking for NVIDIA’s own R&D nvidianews.nvidia.com. With Blackwell in the cloud, smaller AI companies or research groups get access to the same cutting-edge hardware that only the largest players had – democratizing to some extent the ability to train huge models or serve AI at scale.

- Enterprise “AI Factories”: Many organizations are now building in-house AI data centers (nicknamed AI factories by NVIDIA) to develop and deploy AI models for their business. Blackwell’s launch is accompanied by reference designs like NVIDIA’s MGX servers and DGX SuperPOD, which let enterprises stand up Blackwell clusters more easily nvidianews.nvidia.com. For instance, Dell, HPE, Lenovo, and Supermicro are all bringing out servers with Blackwell HGX boards (8× B200 GPUs per board) nvidianews.nvidia.com nvidianews.nvidia.com. An enterprise could use such a cluster to power everything from internal analytics to customer-facing AI features. One notable point is energy efficiency: Blackwell’s improvements mean that the cost per training or per inference drops, making it financially feasible to apply AI in more scenarios. Jensen Huang claims that with Blackwell, the industry is “transitioning to GPU-accelerated AI factories” as the new norm for enterprise IT infrastructure research.aimultiple.com research.aimultiple.com. We see this in partnerships like NVIDIA with pharmaceutical company Lilly for on-premise drug discovery AI, and with IT firms like Foxconn for smart manufacturing – all using Blackwell-powered systems research.aimultiple.com.

- Analytics, HPC and Science: It’s not just neural networks – Blackwell is also being used to accelerate traditional high-performance computing (HPC) and data analytics. The press release highlights use cases such as engineering simulation, EDA (chip design), and even quantum computing research benefitting from Blackwell nvidianews.nvidia.com. Software vendors Ansys, Cadence, and Synopsys (key in simulation and electronic design) are optimizing their tools for Blackwell GPUs nvidianews.nvidia.com. For example, a structural simulation that took hours on CPU clusters might run much faster on GPUs using Blackwell’s compute. Similarly in healthcare, “computer-aided drug design” can leverage Blackwell GPUs to screen compounds or simulate protein interactions far more efficiently nvidianews.nvidia.com. Major medical centers and research labs are also using GPU-accelerated genomics and medical imaging; Blackwell extends this with its large memory (useful for genomic databases) and secure computing (important for patient data privacy) nvidianews.nvidia.com. In summary, Blackwell in the data center is a universal accelerator – not only for AI models but for any workload that can exploit parallel computing, from big data to scientific research.

Healthcare and Life Sciences

The healthcare sector stands to gain significantly from Blackwell-powered AI due to its need for processing large, sensitive datasets:

- Medical Imaging and Diagnostics: Neural networks are being used to detect diseases in imaging modalities like MRI, CT, and X-rays. These models (e.g. detecting tumors) often require very high resolution and large 3D volumes. Blackwell’s memory and compute enable analyzing whole-body scans or high-res pathology slides in one go, which was hard with smaller GPUs. Moreover, the confidential computing feature means hospitals can run these analyses on shared cloud servers without risking patient data leaks nvidia.com nvidianews.nvidia.com. This can accelerate deployment of AI diagnostic tools, even across hospitals that share a cloud instance, since each can keep data encrypted.

- Genomics and Drug Discovery: Genomic sequencing data and molecular simulations produce huge datasets. Blackwell’s decompression and Grace CPU memory synergy can accelerate genomics pipelines (e.g., compressing data in CPU memory and streaming to GPU for alignment or variant calling). NVIDIA has mentioned that databases and Spark-based analytics see big boosts – for example, Blackwell with Grace CPU achieved an 18× speedup in database processing compared to CPU-only systems cudocompute.com cudocompute.com. For pharma companies doing virtual screening of billions of compounds, Blackwell can dramatically shorten the time to sift through candidates, essentially serving as a supercomputer for drug discovery in a box.

- AI in Clinical Workflows: The earlier example of medical robots in a smart hospital (Mackay Memorial in Taiwan) illustrates how Blackwell enables new clinical applications worldbusinessoutlook.com worldbusinessoutlook.com. Those robots use on-premise Blackwell GPUs to understand speech, retrieve medical information, and navigate the hospital. In a broader sense, hospitals could use Blackwell servers as centralized AI hubs – handling everything from predicting patient deterioration (via large temporal models on vital signs) to optimizing operations (like bed management using reinforcement learning). Blackwell’s RAS features ensure these critical systems run reliably 24/7, and the secure enclaves protect patient data when models are trained on sensitive health records. As one hospital executive involved in the robot pilot said, “this partnership enhances patient service quality and optimizes internal workflows” worldbusinessoutlook.com – a statement likely to be echoed as AI becomes ingrained in healthcare operations.

Comparing Blackwell to Other AI Accelerators

While NVIDIA currently leads the AI accelerator market, Blackwell faces competition from alternative hardware platforms. Here we compare Blackwell with notable competitors:

AMD Instinct MI300 Series (and Successors)

AMD’s Instinct line is NVIDIA’s primary GPU competitor in data center AI. The latest MI300X and MI300A accelerators (based on AMD’s CDNA3 architecture) share some design philosophies with Blackwell – notably, they use a chiplet-based design and HBM memory. The MI300A is an APU that combines a CPU and GPU on one package (reminiscent of NVIDIA’s Grace+Blackwell superchip concept), while MI300X is a GPU-only variant with 192 GB of HBM3. In terms of performance, AMD has claimed MI300X can match or exceed NVIDIA’s Hopper (H100) on certain inference tasks research.aimultiple.com research.aimultiple.com. Indeed, independent MLPerf results showed AMD’s MI325 (a variant of MI300) performing on par with Nvidia’s H100 (a “H200” refresh) on Llama-70B language model inference spectrum.ieee.org. However, NVIDIA’s Blackwell still appears to be well ahead at the ultra-high end – one analysis noted that if raw throughput (tokens/sec at low latency) is the metric, “NVIDIA Blackwell is in a league of its own” among 2024–2025 accelerators ai-stack.ai. Early indications are that B100 outperforms MI300X by a significant margin (possibly 2–3× in transformer throughput), albeit at high power consumption.

One advantage AMD emphasizes is cost-effectiveness and openness. MI300 GPUs support alternative software stacks like ROCm, and AMD is actively working with open-source AI frameworks (even partnering with Meta and Hugging Face to optimize models for AMD GPUs research.aimultiple.com). For some cloud providers and buyers in China (facing NVIDIA export restrictions research.aimultiple.com), AMD GPUs can be an attractive second source. Still, AMD’s challenge is the software ecosystem – CUDA and NVIDIA’s libraries still enjoy better support. It was telling that a public spat arose when NVIDIA and AMD benchmarked each other’s GPUs: the right software settings made a big difference, and many saw NVIDIA’s stack as more polished research.aimultiple.com research.aimultiple.com. In summary, AMD MI300 series is competitive with NVIDIA’s last generation (Hopper), and AMD’s next-gen (MI350, slated to compete with Blackwell/H200 research.aimultiple.com) will try to close the gap. But as of now, Blackwell retains a performance lead at the top end, especially for the largest models and cluster-scale deployments.

Intel (Habana Gaudi and forthcoming “Falcon Shores”)

Intel’s efforts in AI accelerators have been twofold: the acquired Habana Gaudi line for AI training, and Intel’s in-house GPU architectures (Xe HPC). The Gaudi2 accelerator (launched 2022) offered an alternative to NVIDIA’s A100 for training, with competitive performance on ResNet and BERT benchmarks at lower price. However, Gaudi2 struggled with software adoption, and while Gaudi3 was announced, Intel’s sales expectations for it were modest (~$500M in 2024) research.aimultiple.com research.aimultiple.com. Intel has recently undergone strategic shifts – the much-hyped Falcon Shores project, originally envisioned as a hybrid CPU+GPU XPU to rival Grace Hopper, faced delays and re-scoping. Intel initially “de-XPUed” Falcon Shores into a GPU-only design and planned it for a 2025 release hpcwire.com hpcwire.com. There are even reports Intel might cancel or radically pivot these high-end AI chips to focus on specific niches (like inference accelerators) where they have an edge crn.com bloomberg.com.

In the meantime, Intel’s most concrete product is the Ponte Vecchio / Max Series GPU, which powers the Aurora supercomputer. Ponte Vecchio is a complex 47-tile GPU that was delayed for years, and its derivatives (known as Rialto Bridge) were cancelled. Aurora’s GPUs are delivering good FP64 HPC performance, but in AI they roughly equate to an A100/H100 level in many tasks. Intel’s challenge has been execution and scale – their architectures are theoretically powerful, but getting silicon out on time and with robust drivers has proven very hard.

In direct comparison, Blackwell vs Intel: currently, there is no Intel product that directly challenges Blackwell’s combination of training performance and ecosystem. Intel’s strategy seems to be shifting toward using their CPUs (with AI extensions) and maybe smaller Gaudi accelerators for inference, rather than duking it out in the largest training clusters. As one HPC analyst put it, Intel appears to be “conceding the AI training market to GPU rivals” and focusing on easier wins hpcwire.com. The implication is that Blackwell will likely dominate the high-end training segment uncontested by Intel until at least 2025/2026 when/if Falcon Shores debuts. Even then, rumors suggest Falcon Shores may aim for a niche (possibly a very high power 1500W design for specific workloads) reddit.com wccftech.com, so it’s unclear if it will truly rival a Blackwell-based DGX in general use. For now, Intel remains a distant third in AI acceleration, with its strength in CPUs still relevant (e.g., many AI systems use Intel Xeon hosts, and Intel has built AI instructions into CPUs for lighter workloads).

Google TPUs (Tensor Processing Units)

Google has pursued a different path with its in-house TPUs, which are specialized ASICs tailored for neural network workloads (especially Google’s own software like TensorFlow). The latest public generation is TPU v4, which Google has deployed in its data centers and made available on Google Cloud. TPUv4 pods (4096 chips) are reported to achieve ~1 exaflop of BF16 compute and have been used to train large models like PaLM. While exact specs are partially proprietary, TPUv4 is roughly comparable to NVIDIA’s A100/H100 era in performance. However, Google recently announced a next-generation platform codenamed “Trillium” TPU v5 (also referred to as TPU v6 in some reports, with Ironwood being a specific design) research.aimultiple.com research.aimultiple.com. The Ironwood TPU chip is said to provide 4,614 TFLOPs of AI compute (likely INT8 or BF16) per chip and scales up to 9216-chip superpods delivering 42.5 exaflops research.aimultiple.com. Notably, Google’s TPU v5 has 192 GB HBM per chip (matching Blackwell in memory), 7.2 TB/s memory bandwidth (on par or higher), and an improved interconnect of 1.2 Tbps between chips research.aimultiple.com. It also boasts 2× better power efficiency than TPUv4. These figures indicate that Google’s newest TPUs are in the same class as Blackwell in many respects.

The difference is that TPUs are not widely available beyond Google’s own use and its cloud customers. They excel at workloads like large matrix multiplies and have powered Google products (Search, Photos, etc.), but they form a more closed ecosystem. For example, a TPU is optimized for TensorFlow and JAX workloads on Google Cloud, whereas NVIDIA GPUs are used everywhere with many frameworks. When comparing Blackwell vs TPU for large-scale AI: Blackwell offers more flexibility (supporting a broader range of model types, custom ops, etc.), while TPU may offer slightly better efficiency on well-defined Google workloads. Google is likely to continue using TPUs internally for cost reasons, but tellingly, even Google plans to offer Blackwell GPUs on Google Cloud alongside its TPUs nvidianews.nvidia.com. That suggests a recognition that many customers prefer the NVIDIA stack or need the versatility. In summary, Google TPUs are formidable – the latest rival Blackwell’s raw specs – but they serve a narrower market. Blackwell retains an edge in general adoption and software support, which is why even Google collaborates with NVIDIA (as Pichai noted, they have a “longstanding partnership” with NVIDIA for infrastructure) nvidianews.nvidia.com.

Cerebras (Wafer-Scale Engine)

Cerebras Systems has taken a unique approach by building the Wafer-Scale Engine (WSE) – an AI chip that is literally the size of an entire silicon wafer. The current WSE-2 has 2.6 trillion transistors and 850,000 simple compute cores on one device research.aimultiple.com, dwarfing any conventional chip in transistor count. The advantage of this approach is that all those cores share fast on-wafer memory and communication, avoiding the need for multi-chip networking. For training very large models, Cerebras can sometimes keep the whole model on one wafer, eliminating the complexities of parallel distribution. However, each core is relatively lightweight, and clock speeds are modest, so raw throughput does not scale directly with transistor count. In practice, a Cerebras CS-2 system (with one WSE-2) has demonstrated the ability to train models like GPT-3 in a more straightforward way (no need for GPU-style parallelization across nodes), but performance per dollar has not clearly beaten GPUs except in certain cases. Cerebras recently unveiled the WSE-3 with an even greater transistor count (reportedly 4 trillion transistors) research.aimultiple.com.

Comparing to Blackwell: Cerebras WSE can handle very large networks in memory, but Blackwell’s dense computation and higher frequency means each Blackwell GPU can execute more operations per second on typical deep learning tasks. For example, Blackwell’s 40 PFLOPS at FP4 is hard for Cerebras to match unless their sparsity features are fully utilized. Cerebras markets its solution as simpler to scale (just add more wafers for bigger models, connected by MemoryX and SwarmX fabric), and it shines on very large sparse models or when memory is the bottleneck. But for mainstream dense model training, clusters of GPUs (especially with Blackwell’s improvements) still tend to reach results faster. That said, Cerebras has found a niche in some research labs and is offered as a cloud service by Cerebras itself, appealing to those who want to avoid the complexity of multi-GPU programming. Blackwell’s introduction, however, with its massive unified memory and faster interconnect, likely closes some of the gap that Cerebras was targeting in model size and scale.

Graphcore IPU

Graphcore, a UK-based startup, developed the Intelligence Processing Unit (IPU) with a focus on fine-grained parallelism and high memory bandwidth per compute. An IPU chip contains many smaller cores (1,472 cores in their GC200 chip) each with local memory, allowing massive parallel execution of neural nets with irregular structures. Graphcore’s IPU-POD systems (e.g., IPU-POD256 with 256 chips) have shown strong performance on certain workloads like sparse neural networks and graph neural nets. Graphcore’s approach is less about raw TFLOPS and more about executing models where dependencies are complex (not just big matrix multiplies). In comparing to NVIDIA: Graphcore claims competitive training throughput on some vision models and efficiency on small batch sizes. However, as models moved towards large dense transformers, IPUs struggled to keep up with the sheer FLOPS and memory requirements. Graphcore’s latest Bow IPU uses 3D-stacked memory for more bandwidth, but each chip still has much less memory (≈ 900MB per IPU) compared to a GPU, making large models require many IPUs and complex sharding. NVIDIA’s Blackwell, with enormous memory and specialized Transformer acceleration, likely widens the gap on the most popular workloads (LLMs, etc.). Graphcore has been focusing on specific markets (they’ve had some wins in finance and research institutions research.aimultiple.com) and touting potentially better power efficiency for moderate-sized models. Yet, Blackwell’s efficiency gains and software momentum (PyTorch, etc. mostly optimize first for CUDA) put Graphcore at a disadvantage for general adoption. In short, Graphcore’s IPU is an innovative architecture that competes in niche areas, but Blackwell GPUs remain the preferred workhorse for the broad range of AI tasks.

Tenstorrent and Other AI Chip Startups

A wave of startups is attempting to challenge NVIDIA with novel architectures, often aiming at specific niches like energy efficiency or low-cost inference:

- Tenstorrent: Co-founded by famed chip architect Jim Keller, Tenstorrent designs AI chips based on a flexible dataflow architecture and leverages RISC-V cores. Their latest chip, Wormhole, is offered in both PCIe cards and servers (like Tenstorrent’s Galaxy system) for AI training and inference research.aimultiple.com. Tenstorrent emphasizes a modular design and has even licensed its IP for use in others’ SoCs. They recently raised significant funding (over $200M, including from investor Jeff Bezos) as a bet to take on NVIDIA research.aimultiple.com. Tenstorrent’s strategy appears to be focusing on being a licensable AI accelerator that could be integrated into diverse systems (even automotive or edge). In performance, little public data exists; they are likely competitive with mid-range NVIDIA cards on ResNet or smaller Transformer models, but not near Blackwell’s high end. Their architecture could shine in lower-power or edge datacenter scenarios due to RISC-V programmability and potentially better efficiency. If they continue to innovate, Tenstorrent could carve a space, but in the short term Blackwell dominates in absolute performance and ecosystem.

- Mythic, Groq, d-Matrix, etc.: Several startups target inference acceleration with unconventional methods. Mythic uses analog in-memory computing to do matrix multiplication with very low power. Groq (founded by ex-Googlers who worked on TPU) created a processor that processes instructions in a deterministic pipeline (a “tensor streaming processor”), boasting low latency and high batch-1 performance – Groq claims advantages in certain real-time inference tasks. d-Matrix is building chips for accelerating large language model inference using in-memory compute with digital approach. These startups each address a piece of the market where NVIDIA might be overkill or inefficient: for example, Mythic for ultra-low-power edge devices, Groq for latency-critical systems, d-Matrix for cost-effective LLM serving. However, each also faces the uphill battle of software integration and limited scope. A Groq node might outperform an underutilized GPU on a specific real-time task, but Blackwell’s sheer scale and mature software make it the safer choice for most datacenters. It’s notable that NVIDIA itself is pushing into the inference domain with optimized software (like Triton Inference server) and even Grace Hopper combos for efficient inference. This means startups have to stay far ahead in a niche. None yet threaten Blackwell’s position in high-end training, but they contribute to a diverse accelerator landscape.

- AWS Trainium and Others: Apart from the above, some cloud providers are developing custom AI chips (AWS’s Trainium for training and Inferentia for inference, Microsoft’s rumored Athena chip, etc.). Trainium v2 clusters are reportedly used by AWS internally (e.g. for Anthropic model training) research.aimultiple.com. These custom chips aim to reduce dependency on NVIDIA and optimize for the cloud operator’s specific workloads (often at lower cost). While not “startups”, they are important competitors in that they can steal share from NVIDIA in cloud usage. Blackwell’s adoption by clouds shows NVIDIA is still very much in demand, but the long-term competitive pressure from in-house silicon will influence pricing and features.

Bottom Line: NVIDIA Blackwell currently represents the cutting-edge of AI accelerators in 2025, but competition is robust. AMD is fast following (especially in inference and with memory-rich GPUs), Google’s TPUs challenge NVIDIA in supercomputing scale (albeit only inside Google), and startups/alternatives are innovating around efficiency and integration. As one Bloomberg analysis put it, “For customers racing to train AI systems… the performance edge of Hopper and Blackwell is critical”, but the question is how long NVIDIA can maintain that lead as others invest heavily in AI chips bloomberg.com. So far, NVIDIA’s aggressive roadmap (Blackwell coming just 2 years after Hopper with huge gains) has kept it ahead of the pack.

Future Outlook: Trends in AI Hardware Acceleration

With Blackwell setting new benchmarks, what comes next for AI hardware? Several key trends are visible on the horizon:

- Continued Multi-Chip and Chiplet Evolution: Blackwell’s dual-die design is likely just the beginning. Future accelerators may integrate even more chiplets – for example, splitting functionality into compute tiles and memory tiles, or mixing GPU cores with specialized AI cores. AMD and Intel are already exploring 3D stacking (e.g., AMD’s V-Cache on CPUs, potential for stacking HBM or SRAM on GPUs). NVIDIA could adopt 3D integration in future architectures to place cache or logic above compute dies for speed and efficiency. The new UCIe chiplet interconnect standard might allow mixing and matching chiplets from different vendors on one package (imagine a future module with a NVIDIA GPU chiplet and a third-party AI accelerator or custom IO chiplet together). The success of Blackwell’s MCM ensures that the era of monolithic giant dies is over – chiplet designs will be the norm for high-end accelerators to keep scaling performance.

- Specialization for AI Workloads: As AI workloads diversify, we may see more specialized units within accelerators. Blackwell already added the Transformer Engine. Future designs might include dedicated hardware for recommendation algorithms (which involve sparse memory lookups), or for graph neural networks, or for reinforcement learning simulations. There’s also interest in analog computing for neural nets (as pursued by Mythic) to drastically reduce power, though that might appear in niche products first. Additionally, we can expect support for new numeric formats – Blackwell’s FP4 may be followed by novel variations (e.g., block floating point, stochastic rounding techniques) to squeeze more efficiency out. Essentially, the “tensor core” concept will expand to cover a wider array of AI operations.

- Advances in Interconnects – Optical and Beyond: NVLink 5 is electrical, but as GPU clusters reach towards exascale computing, copper interconnects may hit limits in reach and energy. The industry is researching optical interconnects for rack-scale and even chip-to-chip communication. NVIDIA’s acquisition of networking companies (Mellanox, Cumulus, etc.) and projects like Quantum InfiniBand switches with in-network compute (SHARP) show an emphasis on networking tech. In coming years, we might see GPUs with optical I/O for direct fiber connectivity between servers, or photonic NVLink-like interfaces that maintain high bandwidth over longer distances. This would enable even larger disaggregated clusters (potentially thousands of accelerators) behaving as one, which is useful for giant models and distributed inference.

- Energy Efficiency and Sustainability: As models and data centers grow, power consumption is a major concern. Blackwell GPUs are high wattage (likely 700W+ for a B100 SXM module), and while they are more efficient per compute than predecessors, the total power draw of AI infrastructure is climbing. Future hardware will need to improve performance per watt substantially. Strategies include moving to smaller process nodes (3nm, 2nm), using newer transistor types (Gate-all-around FETs), dynamic voltage/frequency scaling tailored to AI load, and better cooling (NVIDIA already introduced immersion and liquid-cooled configurations for Blackwell HGX systems nvidia.com). We may also see architectural shifts like mixing lower precision and analog compute for parts of networks to cut power. AI accelerators for edge and IoT will also proliferate – these prioritize low power, and IP from companies like ARM, Qualcomm, and Apple (neural engines in smartphones, etc.) will filter down from what’s learned at the high end. NVIDIA itself might introduce a successor to the Jetson line with a Blackwell-derived architecture optimized for edge inferencing in robotics, cameras, and vehicles, bringing some of the data center capability to lower-power domains.

- Computing at the Edge vs. Cloud Balance: With hardware becoming more capable, some AI tasks that currently require cloud backend might move on-device. For example, future AR/VR glasses or home robots could have mini-Blackwell level accelerators to run complex AI locally (for latency and privacy reasons). This could lead to a more federated AI compute model. The edge computing trend means hardware acceleration is needed not just in big servers but in small, deployable forms. We might see Blackwell’s influence in SoC designs (like the DRIVE Thor for cars, we may see similar for drones or industrial controllers). The challenge is delivering high performance in constrained power/thermal envelopes – something startups like EdgeCortex or mobile chipmakers are tackling. Over time, expect the distinction between “AI GPU” and general SoC to blur, as virtually all computing devices incorporate AI acceleration capabilities.

- Integration of AI and Traditional HPC: The future might also bring more integration between CPU and GPU (or AI accelerators). NVIDIA’s Grace (CPU) + Blackwell (GPU) superchip is one step. AMD’s APUs are another. Intel’s original Falcon Shores vision (x86 + Xe GPU) aimed similarly. As memory coherency standards improve (like CXL for connecting memory between accelerators and CPUs), we could see systems where AI accelerators have unified memory with CPUs, reducing data copying overhead. This is important for workflows that combine simulation and AI (e.g., using an AI model within a physics simulation loop). In the long run, perhaps “XPU” architectures emerge that package different types of cores – scalar, vector, matrix – catering to all aspects of an application. For now, the combination of Grace CPUs with Blackwell GPUs over NVLink is a leading example of this trend, providing nearly 1 TB/s coherence which merges CPU-style tasks and GPU tasks smoothly nvidia.com. Future chips might integrate even tighter (possibly on the same die when feasible).

In essence, the future of AI hardware will involve pushing performance limits while also focusing on efficiency and new form factors. The competition will spur rapid innovation – NVIDIA will not sit still, and neither will AMD, Intel, Google, or the myriad startups. We’re likely to see a diversity of accelerators optimized for different scales (cloud, edge) and purposes (training, inference, specialization). However, given NVIDIA’s current momentum with Blackwell, it’s expected they will set the pace, at least in the near term. Jensen Huang often refers to “accelerated computing” as NVIDIA’s grand direction nvidianews.nvidia.com, implying GPUs evolving to accelerate any computational task. Blackwell and its successors may thus become increasingly general, taking on workloads beyond neural networks – from data processing to possibly AI-driven database queries – blurring the line between AI chips and general processors.

Market Impact and Implications

The introduction of Blackwell is having a profound impact on the AI industry and market:

- Cloud Service Providers: Hyperscalers (AWS, Azure, Google Cloud, Oracle) are racing to deploy Blackwell GPUs in their data centers because client demand for AI compute is insatiable. Each has announced Blackwell availability in 2024–2025 nvidianews.nvidia.com. This will likely reinforce NVIDIA’s dominance in cloud GPU share, even as those providers develop their own chips. In the short term, cloud customers will benefit from access to more powerful instances – e.g., an AWS user can rent a Blackwell instance and get much faster training throughput or serve more AI queries per dollar than before. This could potentially drive cloud AI costs down (or at least performance up at the same cost), enabling startups to do feats (like training a new large model) that previously only a well-funded lab could. On the flip side, clouds will carefully monitor costs; Blackwell GPUs are extremely expensive (tens of thousands of dollars each), so cloud pricing will reflect the premium nature. Already, cloud GPU capacity was constrained due to high demand for H100 – with Blackwell’s even greater popularity (and limited early supply), we might see shortages or allocation issues continue into 2025. The cloud providers that secure large allocations of Blackwell (like Oracle boasting early access, or AWS through co-development deals nvidianews.nvidia.com) could attract more AI-heavy customers.

- Enterprises and AI Adoption: For large enterprises, Blackwell-based systems lower the barrier to adopting advanced AI solutions. Industries like finance, telecom, retail, and manufacturing are in a race to infuse AI into their operations and products. With Blackwell’s efficiency, an enterprise can get the necessary horsepower with fewer nodes – for instance, where you needed a room of 16 DGX servers before, maybe 4 Blackwell-based systems suffice for the same AI workload. This reduces not just hardware count but also power and space usage (important for companies concerned about data center energy bills and carbon footprint). We can expect a wave of AI modernization projects as Blackwell becomes available: for example, banks upgrading their risk modeling and fraud detection platforms with Blackwell clusters to run more sophisticated models, or automotive firms using Blackwell to vastly speed up autonomous driving development (as seen with multiple automakers switching to Drive Thor). Enterprises will also appreciate features like confidential computing on Blackwell to meet regulatory requirements – e.g., a healthcare company can keep patient data encrypted end-to-end while still leveraging powerful GPUs for analysis nvidia.com.

- AI Startups and Research Labs: For AI-focused startups (whether building novel models or AI-driven services), having Blackwell performance can be a game-changer. It levels the playing field a bit with the big tech companies, because startups can access the same class of hardware through cloud or colocation providers (several AI-dedicated cloud firms like CoreWeave, Lambda, etc., are offering Blackwell in 2024 nvidianews.nvidia.com). This means a well-funded startup could train a state-of-the-art model without having to wait for months in a queue or compromising on model size. We might see faster innovation and more competition in AI model development as a result. That said, it may also create a wider gap between those who can afford cutting-edge hardware and those who cannot. As of now, NVIDIA’s top GPUs are costly and often prioritized to big buyers – a dynamic that led some researchers to complain during the H100 cycle. If Blackwell is as sought-after, some smaller labs might still struggle to get access. This could drive more usage of community supercomputers (like academic clusters with Blackwell funded by government programs) or encourage usage of alternative chips (like AMD, if available sooner or at lower cost). But generally, having Blackwell widely available by mid-2025 will turbocharge AI R&D, likely leading to new model releases and capabilities we haven’t seen yet (because the compute constraint was a bottleneck).

- Competitive Landscape: From a market standpoint, NVIDIA’s launch of Blackwell consolidates its position as the leader in AI hardware. Analysts note that NVIDIA holds around 80-90% of the accelerator market, and Blackwell’s head start will make it hard for others to dent that reddit.com. AMD is the closest competitor – their strategy to capture maybe 15-20% share in coming years depends on MI300’s success and delivering their next gen on time. If Blackwell shows clear supremacy and is adopted everywhere, some customers may not bother evaluating alternatives, thus locking in NVIDIA’s dominance (similar to how CUDA became the default platform). However, the immense size of the AI market (trillions of dollars of opportunities) means there is room for multiple players. We see cloud providers hedging their bets by also investing in custom chips (Google TPU, AWS Trainium). If those prove effective, they could limit NVIDIA’s growth in the cloud segment over time. There’s also geopolitical factors – Chinese tech companies are unable to import the highest-end NVIDIA GPUs due to export controls, which spurs them to develop domestic AI chips (from firms like Biren, Alibaba T-Head, Huawei Ascend). Those domestic chips currently lag a generation or two behind (usually comparable to A100 or so) research.aimultiple.com research.aimultiple.com, but they might improve and create parallel ecosystems. NVIDIA has responded by offering slightly de-tuned versions (like H800 for China). Blackwell might similarly have export-limited variants. The broader implication is a possible fragmentation of the AI hardware market geographically, though in the near term NVIDIA remains the go-to for most of the world.

- Cost and AI Economics: Blackwell’s performance could reduce the cost per training run or per inference significantly, as advertised. This might accelerate the deployment of AI in cost-sensitive sectors. For instance, a 25× efficiency gain in inference could make it feasible to use a large language model in a consumer application that would have been too expensive to run on H100s. One could imagine AI features in software (like office assistants, coding copilots, etc.) becoming cheaper to provide and thus more ubiquitous. We might also see new “AI-as-a-service” offerings leveraging Blackwell, where companies offer to train or host models for clients using Blackwell infrastructure (some startups like MosaicML – now part of Databricks – have been doing this with prior-gen GPUs; Blackwell will enhance such services). On the other hand, the absolute cost of top-end GPUs means AI compute spending will remain high – companies might spend similar dollars but just do much more AI with it. In fact, NVIDIA’s own valuation (trillions of dollars in market cap) reflects the market expectation that demand for these accelerators will continue to skyrocket as AI permeates everything. If anything, Blackwell reinforces a trend of AI compute hunger: by providing more supply (compute), it enables new applications, which then drive even more demand.

- Innovation Feedback Loop: Having Blackwell widely deployed might also influence research directions. Researchers can realistically attempt larger experiments or more computationally intensive approaches (like huge ensembles, or training with very long sequences, etc.) that they wouldn’t try on limited hardware. This could lead to breakthroughs that were waiting on compute availability. For example, exploring 3D AI models in full fidelity or multi-modal models that see and hear with unprecedented complexity. It’s analogous to how the availability of HPC enabled new science. In AI, availability of massive compute via Blackwell could unlock new architectures (maybe something beyond Transformers) that simply weren’t tractable before.

- Timeline to Next Gen: Finally, Blackwell’s impact will also depend on how long it stays as the flagship before another leap. NVIDIA has been on roughly a 2-year cadence for major architectures. If that continues, we might expect a successor (code name likely starting with “C” if they follow the alphabetical scientist naming – perhaps “Curie” or similar) by 2026/27. For now, through 2025 and likely 2026, Blackwell will be the backbone of most cutting-edge AI compute installations. Its successful adoption will shape what competitors do (e.g., AMD might accelerate their next launch or Intel might decide whether to double down or pivot further).

In conclusion, NVIDIA Blackwell is not just a new chip – it is a catalyst accelerating the entire AI ecosystem. It empowers engineers and researchers to do more, promises businesses faster insights and smarter products, and pressures competitors to step up their game. From AI mega-datacenters to autonomous machines at the edge, Blackwell and its progeny will drive the next wave of AI innovation, truly taking us “Blackwell and beyond” into the future of accelerated computing.

Sources: The information in this report is drawn from NVIDIA’s official announcements and technical briefs on the Blackwell architecture nvidia.com nvidianews.nvidia.com, analyses by industry experts and publications (IEEE Spectrum, HPCwire, Forbes) on comparative benchmarks spectrum.ieee.org ai-stack.ai, and press releases from NVIDIA’s partners highlighting use cases in cloud, automotive, and healthcare nvidianews.nvidia.com worldbusinessoutlook.com. These sources include NVIDIA’s GTC 2024 keynote announcements nvidianews.nvidia.com, technical blogs cudocompute.com cudocompute.com, and third-party evaluations of emerging AI hardware research.aimultiple.com bloomberg.com. Together, they provide a comprehensive picture of Blackwell’s capabilities and its context in the evolving AI hardware landscape.